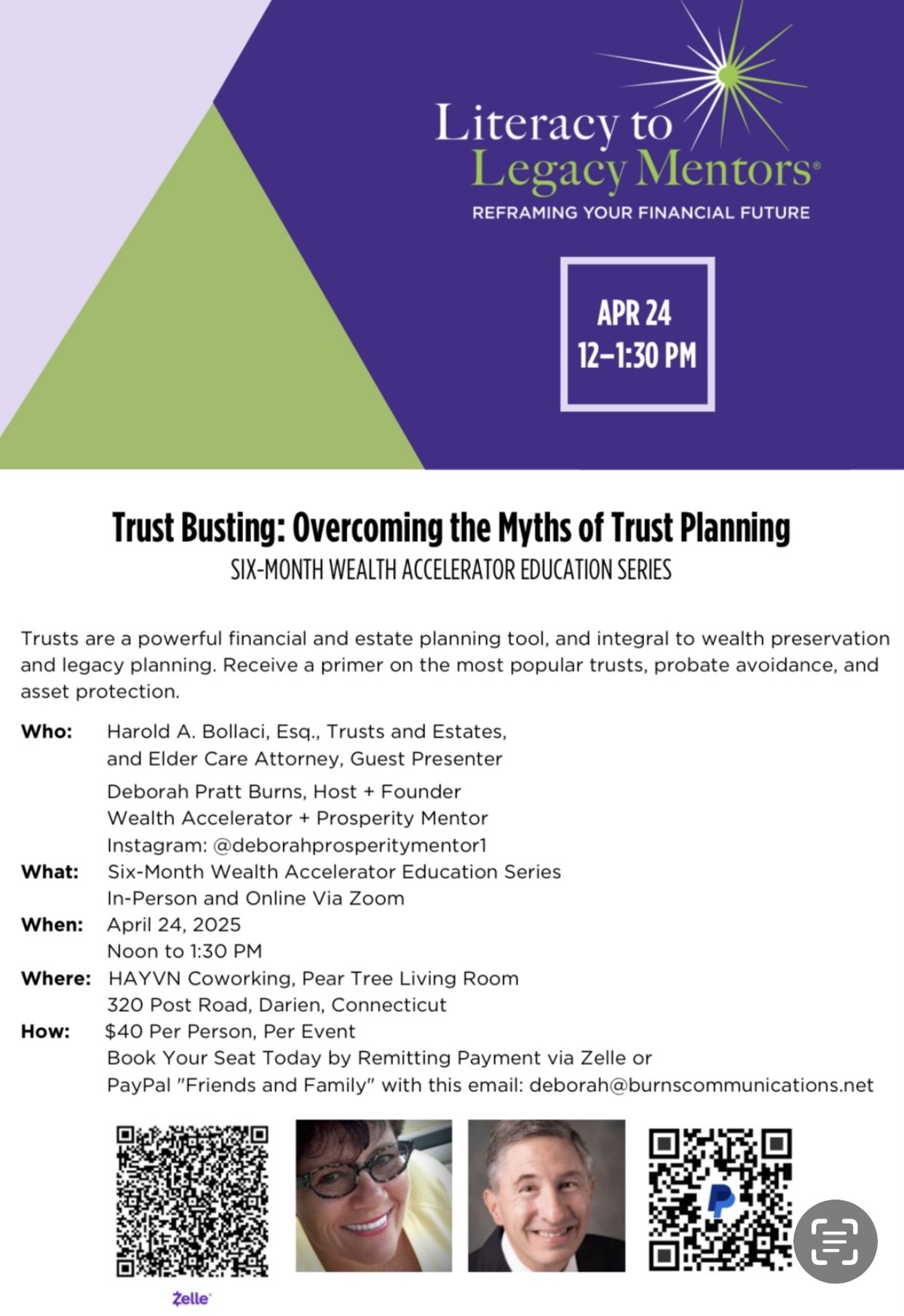

Trusts + Legacy Planning

Why It’s Important To Establish a Comprehensive Estate Plan..Now!

Establishing a comprehensive estate plan is a vital component of any life and legacy strategy. Whatever your stage of life, net worth, or personal and family circumstances, it is recommended that every adult over the age of 18 craft an estate plan with a qualified Estates and Trusts attorney, and your plan should be reviewed and updated as needed.

Not only will a proper estate plan help you protect the assets you have worked hard to acquire, but you will also gain added peace of mind knowing that your assets and your personal and family legacy plan has been properly developed and implemented, so that you, your spouse, and your loved ones are protected and provided for in the event of any possible contingency. Planning ahead and developing a sound legal strategy to address your estate and legacy planning can save your loved one’s needless expense and heartache in the future.

In addition, an estate plan should also address a client’s personal and medical wishes, such as who will make important medical and financial decisions for them in the event, they are ever unable to, in addition to whom they wish to leave their assets to. There are many legal and personal considerations that should be taken into account when making these decisions, and a qualified legal professional can guide you through the process.

Literacy to Legacy Mentors has a network of experienced estates and trusts and elder care attorneys in multiple states that we recommend to our clients to address all aspects of estate planning including: Wills, Trusts, Healthcare Documents, Living Wills, Powers of Attorney, Tax Saving Strategies, Guardianships, Charitable Giving, and more.